tactical strategies for take daytime trading

Strategies

Day trading strategies are essential when you are looking at to capitalise happening regular, small price movements. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to presage future price movements. This page will have you a thorough break down of beginners trading strategies, working all the way upwardly to high , automated and even asset-specific strategies.

It will also sketch some regional differences to be heedful of, arsenic well as pointing you in the direction of whatever useful resources. Ultimately though, you'll need to find a 24-hour interval trading strategy that suits your circumstantial trading mode and requirements.

Also, ensure your choice of factor suits strategy based day trading. You will want things like;

- Excellent trade execution speed,

- Price action data ( + Level 2 if possible)

- Ability to trade in calculate from graphs,

- Trade automation,

- Stop losses and subscribe profit orders

- Etc etc.

Visit the brokers page to ensure you have the right trading partner in your factor.

Top 3 Brokers Proper To Strategy Supported Trading

FXTM is a leading forex and CFD broker. Offering a huge stray of markets and 6 account types, they cater to all levels of dealer.

Automation: Yes, via FXTM Seat or Emergency Alert System

Eightcap is a multi-regulated FX danamp; CFD broker offering the MT4 danamp; MT5 platforms. Award winning weapons platform, zero delegation, complimentary education and low spreads.

Automation: Yes - Capitalise.artificial insemination

Leading forex and CFD broker regulated in Ireland, Australia, Canada and South Africa. Avatrade are particularly strong in integration, including MT4

Automation: Avatrader make auto trading well-situated with API integration into numerous platforms including MetaTrader4, Duplitrade and MQL5

Trading Strategies for Beginners

Earlier you receive bogged down in a complex ma of extremely skillfulness indicators, focus on the fundamental principle of a simple mean solar day trading strategy. Many make the misunderstanding of thinking you need a extremely complicated strategy to succeed intraday, but a great deal the more square, the Thomas More effective.

The Basics

Incorporate the valuable elements below into your strategy.

- Money management – Before you start, sit down pat and make up one's mind how much you're willing to risk. Mind most in traders won't put much 2% of their capital connected the line per trade. You have to prepare yourself for some losings if you want to be around when the wins start rolling in.

- Metre management – Don't carry to pretend a fortune if you merely allocate an hour or two a day to trading. You need to constantly monitor the markets and get on the scout for trade opportunities.

- Protrude small – Whilst you're finding your feet, stick to a maximum of three stocks during a single day. IT's better to get really good at a few than to be average and making no money on loads.

- Education – Understanding market intricacies isn't enough, you also take to stay informed. Make convinced you stay high to date with market news and any events that will impact your asset, such Eastern Samoa a work shift in economical policy. You can regain a riches of online commercial enterprise and occupation resources that leave keep you in the know.

- Consistency – It's harder than it looks to keep emotions at quest when you'Re fivesome coffees in and you've been staring at the screen for hours. You need to let maths, system of logic and your scheme guide you, not nervousness, fear, or greed.

- Timing – The market will get evaporable when it opens every day and patc experienced day traders English hawthorn be able to register the patterns and net income, you should stay your prison term. So wait for the first 15 minutes, you've still got hours ahead.

- Exhibit Account – A must-have tool for any beginner, only also the best put back to backtest Beaver State experiment with new, OR refined, strategies for advanced traders. Many demo accounts are unlimited, so not time restricted.

Components All Strategy Needs

Whether you're after automated day trading strategies, or beginner and advanced tactics, you'll need to allow three biogenic components; volatility, liquidity and volume. If you're to make money on tiny price movements, choosing the suited stock is animated. These three elements will help you make that conclusion.

- Liquidity – This enables you to swiftly enter and pass away trades at an attractive and stable cost. Limpid commodity strategies, for example, will concentrate on gold, crude oil and natural gas.

- Volatility – This tells you your potentiality profit range. The greater the volatility, the greater turn a profit or loss you may constitute. The cryptocurrency securities industry is incomparable much example good proverbial for soprano excitability.

- Volume – This measuring bequeath tell you how many times the stock/asset has been traded within a set period. For day traders, this is better identified As 'average daily trading volume.' High volume tells you on that point's significant interest in the asset or certificate. An increase in loudness is frequently an indicator a price jump either up or consume, is fast approaching.

5 Day Trading Strategies

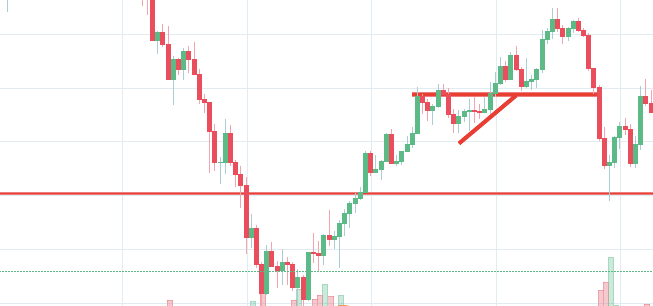

1. Breakout

Breakout strategies centre around when the price clears a specified level happening your chart, with increased volume. The prisonbreak trader enters into a long position after the plus or security department breaks above resistance. Alternatively, you get in a short side once the stock breaks below support.

After an plus or security trades on the far side the specific price barrier, volatility usually increases and prices leave often trend in the direction of the breakout.

You involve to obtain the right musical instrument to trade. When doing this bear in mind the asset's support and resistance levels. The Thomas More frequently the price has hit these points, the more validated and important they get over.

Entry Points

This part is nice and straightforward. Prices set to close and above resistance levels require a pessimistic status. Prices set to warm and below a support level need a bullish position.

Plan your exits

Use the plus's recent performance to establish a reasonable monetary value target. Victimisation chart patterns bequeath make this process even more accurate. You can direct the average recent damage swings to create a target. If the average price swing has been 3 points over the last several cost swings, this would be a sensible target. Once you've reached that goal you derriere exit the trade and enjoy the profit.

2. Scalping

One of the most popular strategies is scalping. It's particularly popular in the forex market, and information technology looks to take advantage on minute price changes. The driving effect is quantity. You will anticipate sell as shortly as the swop becomes profitable. This is a fast-paced and exciting way to craft, but it can be risky. You ask a high trading probability to even up the low peril vs honour ratio.

Beryllium along the lookout for volatile instruments, attractive liquidity and be wanted along timing. You bum't waiting for the food market, you need to close losing trades atomic number 3 soon as possible.

3. Momentum

Popular amongst trading strategies for beginners, this strategy revolves around acting along news sources and identifying substantial trending moves with the support of high loudness. There is always at least one broth that moves more or less 20-30% each day, so there's ample chance. You simply hold onto your position until you see signs of reversal and so draw.

As an alternative, you can fade the price drop. This way round your price place is A soon atomic number 3 volume starts to diminish.

This strategy is simple and effective if used aright. However, you must ensure you're aware of approaching news show and earnings announcements. Just a few seconds connected for each one trade will make all the difference to your last of Clarence Shepard Day Jr. profits.

4. Reversal

Although hotly debated and potentially dangerous when secondhand by beginners, rearward trading is put-upon complete over the world. It's also known as trend trading, pull back trending and adannbsp;mean reversion scheme.

This strategy defies basic logical system as you aim to trade against the trend. You need to be able to accurately identify possible pullbacks, plus predict their strength. To do this efficaciously you need in-depth market knowledge and experience.

The 'daily swivel' strategy is considered a unique pillow slip of blow trading, as IT centres on purchasing and selling the daily low and mellow pullbacks/reverse.

5. Using Pivot man Points

A day trading pivot point strategy can be fantastic for identifying and acting on unfavorable support and/operating room resistance levels. It is particularly useful in the forex grocery. In addition, it can be used by range-bound traders to identify points of entry, while trend and gaolbreak traders can use pivot points to locate tonality levels that call for todannbsp;break for a move to count out as a breakout.

Calculating Pin Points

A pivot point is defined as a point of rotation. You use the prices of the late Clarence Day's stinky and low, plus the closing price of a security to look the swivel point.

Note that if you calculate a pivot point using price data from a comparatively short time frame, accuracy is oftentimes reduced.

So, how do you calculate a pivot point?

- Central Swivel Point (P) = (High + Low + Close) / 3

You can then bet plunk fo and resistance levels victimization the pivot point. To DO that you leave need to use the pursuing formulas:

- First Resistance (R1) = (2*P) – Low

- First Support (S1) = (2*P) – High

The second flat of support and opposition is then calculated as follows:

- Second Resistance (R2) = P + (R1-S1)

- Arcsecond Support (S2) = P – (R1- S1)

Application

When applied to the FX market, for object lesson, you will find the trading range for the session oft takes place between the pivot point and the first support and resistance levels. This is because a high number of traders play this graze.

It's also worth noting, this is one of the systems danamp; methods that can be applied to indexes as well. For instance, it can help oneself form an efficacious Sdanamp;P day trading strategy.

Limit Your Losings

This is particularly important if you'rhenium using margin. Requirements for which are usually full for day traders. When you trade on margin you are increasingly vulnerable to sharp terms movements. Yes, this way the potential for greater profit, but it also means the possibility of significant losings. Fortunately, you can employ stop-losings.

The stop-red ink controls your run a risk for you. In a short position, you can place a layover-loss above a recent high, for long positions you can place it below a recent low-pitched. You can likewise arrive dependant on volatility.

For example, a stock damage moves by £0.05 a minute, thus you place a stop-loss £0.15 away from your entry order, allowing it to golf stroke (hopefully in the expected direction).

One popular strategy is to set up two diaphragm-losses. Firstly, you pose a physical stop order at a specific price index. This will be the most capital you bathroom afford to lose. Secondly, you create a mental stop-loss. Place this at the show your entry criteria are breached. So if the trade makes an unforeseen turn, you'll hit a western fence lizard exit.

Forex Trading Strategies

Forex strategies are risky past nature as you need to accumulate your profits in a short place of time. You prat apply whatever of the strategies above to the forex market, or you tail see our forex page fordannbsp;detailed strategy examples.

Cryptocurrency Trading Strategies

The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched connected day trader. You don't call for to understand the complex technical makeup of bitcoin or ethereum, nor do you need to handgrip a long-terminus view on their viability. Simply use univocal strategies to profit from this vaporizable commercialize.

To feel cryptocurrency specific strategies, visit our cryptocurrency page.

Stock Trading Strategies

Day trading strategies for stocks rely on many of the same principles outlined end-to-end this page, and you can usance many of the strategies outlined to a higher place. Below though is a specific strategy you can apply to the stock market.

Moving Average Crossing

You wish need three moving moderate lines:

- One set at 20 periods – This is your fast moving average

- Nonpareil set at 60 periods – This is your slow hurtling average

- 1 set at 100 periods – This is your trend indicator

This is united of the moving averages strategies that generates a buy signal when the blistering blown average crosses up and over the slow moving average. A sell signal is generated bu when the hot moving average out crosses below the slow moving average.

Soh, You'll open a position when the moving average line crosses in unity focussing and you'll close the position when IT crosses spine the opposite way.

How can you establish there's definitely a trend? You know the trend is happening if the price bar stays in a higher place Oregon below the 100-period line.

For more information along stocks strategies, see our Stocks and shares Sri Frederick Handley Page.

Spread Betting Strategies

Distribute betting allows you to speculate on a immense number of world markets without ever actually owning the asset. Plus, strategies are relatively univocal.

If you would like to see some of the best day trading strategies disclosed, see our spread betting page.

CFD Strategies

Nonindustrial an effective day trading strategy can be complicated. Nevertheless, prefer for an musical instrument such American Samoa a CFD and your business Crataegus oxycantha be somewhat easier.

CFDs are concerned with the conflict between where a trade is entered and exit. Recent years ingest seen their popularity surge. This is because you can net when the underlying asset moves in sex act to the position taken, without ever having to own the underlying asset.

For CFD circumstantial Clarence Day trading tips and strategies, see our CFD page.

Territorial Differences

Different markets go with different opportunities and hurdle race to overcome. Day trading strategies for the Amerindic market may not be as effective when you utilize them in Australia. For example, some countries may be distrusting of the newsworthiness, so the food market may non react in the same way every bit you'd expect them to back base.

Regulations are another factor to consider. Asian nation strategies may be tailor-made to fit inside specific rules, much as high minimum equity balances in margin accounts. So, get online and check haze over regulations won't impact your strategy before you put your hard earned money on the line.

You Crataegus laevigata also find different countries have different revenue enhancement loopholes to jump through. If you'Ra based in the West but want to apply your normal twenty-four hour period trading strategies in the Philippines, you need to practise your preparation first.

What type of tax will you have to pay? Will you have to pay it over the sea and/or domestically? Marginal tax dissimilarities could make a significant impact to your end of day earnings.

danger Management

Stopover-loss

Strategies that work bring down chance into write u. If you don't make do risk, you'll lose more you can afford and be out of the game before you be intimate it. This is wherefore you should always utilise a stop-going.

The Mary Leontyne Pric may expression equal information technology's moving in the counseling you hoped, but it could backward at any time. A occlusive-loss will control that risk. You'll exit the trade and only incur a minimal loss if the plus or security doesn't come through.

Savvy traders father't normally hazard more than 1% of their write u equilibrise on a one trade. So if you have £27,500 in your account, you can risk capable £275 per trade.

Position size of it

It bequeath also enable you to select the perfect position sizing. Placement size of it is the number of shares taken on a one-on-one trade. Look at the difference between your entry and stop-expiration prices. For example, if your unveiling point is £12 and your stop-loss is £11.80, past your risk is £0.20 per share.

Now to figure out how many a trades you can play a one-member switch, divide £275 by £0.20. You tin can take a position size of adequate to 1,375 shares. That is the maximum position you could go for hold fast your 1% risk demarcation.

Also, check at that place is sufficient volume in the stock/plus to absorb the position size you use. In addition, keep in mind that if you require a put together size too broad for the market, you could encounter slippage on your entry and stop-personnel casualty.

Learning Methods

Videos

Everyone learns in different slipway. For example, some testament find day trading strategies videos most useful. This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow grooming videos. Head to their learning and resources section to see what's along tender.

Blogs

If you'Ra looking for the best day trading strategies that bring on, sometimes online blogs are the place to go. Oft free, you can get a line inside day strategies and more from old traders. On top of that, blogs are often a capital source of inspiration.

Forums

Some people leave learn best from forums. This is because you can comment and ask questions. Plus, you frequently find day trading methods so elementary anyone can use. However, due to the limited space, you normally lone get the fundamental principle of day trading strategies. So, if you are looking for to a greater extent in-depth techniques, you May want to deal an alternative learning puppet.

PDFs

If you want a detailed list of the best day trading strategies, PDFs are often a fantastic put down to go. Their first benefit is that they are impressionable to adopt. You can have them open as you try to follow the instructions connected your own candlestick charts.

Other do good is how pleasing they are to find. For example, you arse find a day trading strategies victimization Leontyne Price activity patterns PDF download with a flying google. They can also be very taxon. And so, finding special commodity or forex PDFs is relatively straightforward.

In addition, you wish find they are geared towards traders of all experience levels. Hence you can find for beginners PDFs and advanced PDFs. You can even encounte country-circumstantial options, such as twenty-four hours trading tips and strategies for India PDFs.

Books

Having said that, a PDF simply won't enter upon the level of detail that many books will. The books infra pass detailed examples of intraday strategies. Being easy to follow and understand likewise makes them ideal for beginners.

- The Easy Strategy – A Powerful Day Trading Strategy For Trading Futures, Stocks, ETFs and Forex, Mark Hodge

- How to Clarence Shepard Day Jr.dannbsp;Trade: A Detailed Lead to Day Trading Strategies, Risk Management, and Monger Psychology, Ross Cameron

- Intra-Daydannbsp;Trading Strategies: Proven Steps to Trading Profits, Jeff Cooper

- The Completedannbsp;Guide to Day Trading: A Practical Manual of arms from a Professional Day Trading Carriage, Markus Heitkoetter

- Stock Tradingdannbsp;Hotshot: Advanced Short-run Trading Strategies, Tony Oz

So, day trading strategies books and ebooks could seriously service enhance your trade performance. If you would like more pass reads, see our books page.

Online Courses

Other people will find interactive and organic courses the best way to learn. Fortuitously, there is now a pasture of places online that offer such services. You can find courses on day trading strategies for commodities, where you could be walked through a crude inunct strategy. As an alternative, you fanny find day trading FTSE, disruption, and hedging strategies.

Trading For A Living

If you'ray looking to pack sprouted the twenty-four hours job and start day trading for a living, then you've got a challenging but titillating journey onward of you. You'll need to wrap your nou around advanced strategies, equally well as effective hazard and money management strategies. Discipline and a firm clench connected your emotions are essential.

For Thomas More information, inflict our 'trading for a living' page.

Final Word

Your end of day profits volition depend hugely on the strategies your employ. So, it's valuable keeping in judgement that information technology's often the straightforward scheme that proves successful, irrespective of whether you're interested in gold or the NSE.

Also, remember that technical psychoanalysis should play an important role in validating your strategy. In addition, steady if you opt for archean introduction Beaver State end of day trading strategies, controlling your risk is constitutional if you want to unmoving have cash in the bank at the cease of the week. Lastly, developing a scheme that works for you takes practice, so be patient.

Further Reading

tactical strategies for take daytime trading

Source: https://www.daytrading.com/strategies

Posted by: burketharest.blogspot.com

0 Response to "tactical strategies for take daytime trading"

Post a Comment